- Skrill has recently emerged as one of the major online platforms.

- Skrill was originally known as Moneybookers and was founded in London in 2001.

- Integration with prominent tech behemoths like Facebook and eBay almost likely aided.

- Skrill has also been quick to recognize an opportunity in the bitcoin market.

Skrill has recently emerged as one of the major online platforms for money transfers and online payment processing. Its convenience and speed are just two of the main reasons that more users are signing up for e-wallet services like Skrill to improve the efficiency of transferring funds from one account to another, making life easier, such as what happens with sites like oddschecker, which have been offering bonuses and information in gaming, giving a plus to this online world in which we are becoming more involved every day.

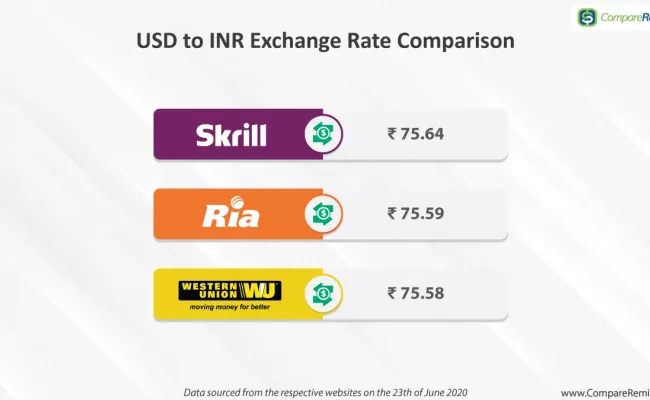

The Skrill platform’s overarching goal is to become the go-to portal for low-cost international money transfers – the Western Union of the digital world if you will.

In this post, we’ll look at the advantages of e-wallets in general, Skrill’s rise, and the industries it’s most suited to in 2022 and beyond.

Table of Contents

What exactly is an e-wallet?

If you are unfamiliar with the concept of e-wallets, let us first define what an e-wallet is.

E-wallets, also known as digital wallets, are software-based platforms that allow account holders to securely store payment information for numerous payment methods, such as debit and credit cards, allowing for faster and easier digital transactions.

E-wallets are becoming more interoperable with mobile payment systems like Apple Pay and Google Pay, allowing customers to make instant payments for goods and services using their smartphone devices.

Digital wallets can also store information on corporate loyalty or VIP cards, as well as online coupons for savings.

The true benefit of a digital wallet is that it does not require users to have a bank account with a traditional bank or branch to get started.

As a result, users without traditional bank accounts can connect and move money more quickly and securely.

Skrill’s story thus far

Skrill was originally known as Moneybookers and was founded in London in 2001.

Moneybookers was bought out by Investcorp for €105 million just six years later.

Moneybookers and other digital wallet services were on the increase during this time, and just two years later, Investcorp placed the company up for sale for around £365 million.

Moneybookers announced it has a customer base of over 25 million, as well as 120,000 accounts from online and offline retailers, expediting B2B transactions as well as consumer payments, only ten years after its inception.

Integration with prominent tech behemoths like Facebook and eBay almost likely aided.

Moneybookers confirmed its rebranding to Skrill near the end of 2011, which was completed in 2013.

Skrill was purchased by CVC Capital Partners in August 2013 for a whopping €600 million.

PaySafeCard, a European prepaid payment provider, was also acquired by the same corporation, and Skrill is now a subsidiary of the Paysafe Group.

Skrill is appropriate for what?

In general, there are numerous excellent applications for a Skrill account.

To begin with, it makes it incredibly simple to send payments to relatives or friends at the touch of a button.

Some sole proprietors and freelancers prefer to request and accept payments for their services through their Skrill account.

In a manner similar to PayPal, users simply submit their email addresses associated with their Skrill account to get paid.

Skrill has recently emerged as a preferred payment method for online casino players seeking quick payments and withdrawals of wins.

Everything You Need to Know About Skrill

Skrill has also been quick to recognize an opportunity in the bitcoin market.

Skrill account members can now buy various cryptocurrencies with their fiat cash balances as of June 2018.

Even better, the new coins can be stored in their Skrill wallet instead of a local cryptocurrency wallet.

What Skrill is not well suited for

Skrill is probably not for you if you’re looking for a prepaid debit or travel card provider, even though it does offers this service.

When compared to other prominent prepaid card providers, the fees are fairly exorbitant.

You will be charged £4.65 regardless of the size of your withdrawal and up to 7.5% if you withdraw directly to another Visa card.

If you are converting one fiat currency to another, you will be charged an additional 3.99% exchange fee.

When you total up all of these fees, you’ll quickly realize there are less expensive options available.

Surprisingly, there is a way to avoid the 3.99% forex markup. Instead of “Skrill to Skrill,” you can utilize the “Skrill Money Transfer” gateway, which has a 0% markup on all currency conversions.

Can you put your money in Skrill’s hands?

Look no further if you like the sound of the Skrill platform but want even more confirmation that the business is legitimate and reliable.

The Skrill platform, first and foremost, is fully licensed and regulated by the Financial Conduct Authority (FCA).

This means that all UK-based users may be confident that their finances and sensitive data are always protected to the highest standards.

It is also permitted for US consumers, with the US Treasury Department’s Financial Crimes Enforcement Network (FinCEN) officially licensing their services on the other side of the Atlantic.

Skrill accounts are also adequately safeguarded with two-factor authentication for your own personal security (2FA).

This adds an extra degree of security by asking users to provide a random six-digit code that changes every 60 seconds, in addition to their password.

Furthermore, all internet connections to Skrill accounts are encrypted with 128-bit Secure Socket Layer (SSL) technology, ensuring that all sensitive data and your cash are protected from cyber-criminals.

What’s the final word?

When you look at the entire expenses of exchanging currencies, it’s fair to assume that the Skrill service is more concerned with efficiency than keeping fees low.

Skrill, on the other hand, compares favorably to well-established portals such as PayPal a quick and secure digital wallet and an online payment provider.